Apr 20, '19

How to reject investors like a pro (What!? and Why?)

It is important to get the ‘right’ investor because you don’t just need a capital source but an investor who is able to contribute a lot more than their dollars.

Hey, it’s not like you are standing in front of all the sharks who are fighting to invest in your idea. But rejecting the wrong investors will prove profitable for your firm in the longer run.

If you are asking yourself the question “Is my idea worth rejecting investors?” Yes, it is. And if not, then you should consider rejecting the idea before you reject the investor.

Your choice can turn your dreams into realities or nightmares. You have to think about the advantages with a futuristic approach- both financially and otherwise. Now let’s discuss this otherwise first.

The Apple story you have not heard

It is 1971 and Bill Fernandez introduces Steve Jobs and Steve Wozniak. These brilliant minds meet and decide to build something that would change the history of substantially everything that is today. Now all they had to do was find a way to make things work- financially. Wozniak had the right brains for the technical part and Jobs had the skills of selling the product. But before the -product was made, this skill came handy in kicking off the project.

Jobs came in touch with Paul Terell, the owner at The Byte Shop and they were successfully able to convince Terell to sell something that not only seemed impossible at that time but also, had no prototype to examine. He pre-ordered 50 machines from the Steves and promised $500 each on delivery. Jobs took this purchase order to Cramer Electronics, the national electronic parts supplier of that time and ordered parts on a 30-day term with a promise of payment for the parts after successful delivery to The Byte Shop.

After working day and night of building and testing, they were successfully able to deliver on time and full payments were made to the supplier with a significant amount left as profit and a budget for celebrations. Jobs was able to finance a potential multi-million-dollar company without selling any share or stock of the company, on a concept as simple as credit and a lot of focused hard work. The talent added tenfold to their success.

Their machine had a lot of innovations with small but significant features that made it special as well as ideal for use, practically by everyone. On the suggestive insistence of Paul Terell, Wozniak also designed a cassette interface for loading and saving programs. But what Terell couldn’t provide them was the finance to build the Apple II. They had to sell Wozniak’s HP scientific calculator and Jobs’ Volkswagen bus; realizing it was just not enough, even after the profits of the first sale. No banks would lend them money for an idea that only seemed bizarre (Hey Siri, play here’s to the crazy ones)

Enter: Mike Markkula- the first investor who believed in the misfits and their bizarre idea. Markkula had acquired millions on stock options as marketing manager for Fairchild Semiconductor and Intel and retired at 32. He did not trust the two young boys but believed in their idea. Jobs tempted him out of retirement to invest in Apple. In 1977, Markkula brought his expertise along with $250,000 to become one-third owner of Apple. He invested less than 10% of his worth at that time and we can imagine what happened next.

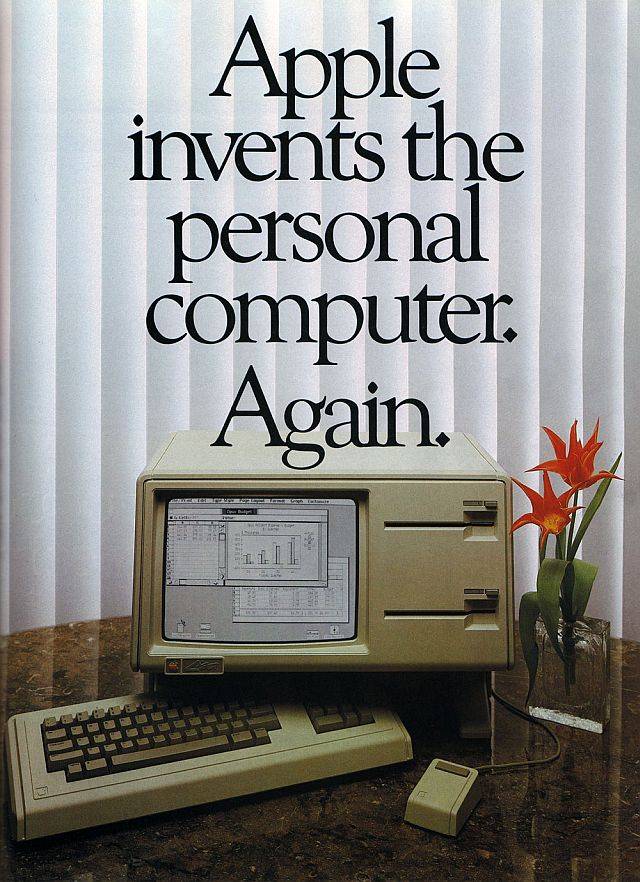

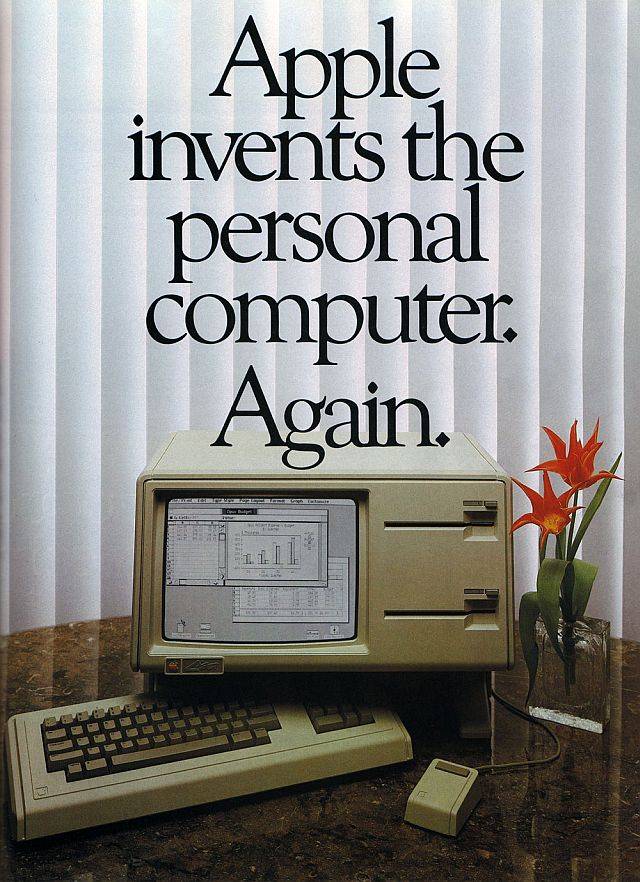

Out of the $250k, he invested $80k as equity and loaned them the remaining amount of $170k. But that was not it. His contribution as an investor transgressed for him to become the chairman of Apple. After becoming the chairman, Markkula was the one who approved the Macintosh. He also prevented Jobs from killing Apple’s Lisa- the first personal computer with a graphical user interface(GUI). Being a trained engineer, he also wrote various Apple II and Apple III programs along with serving as a beta tester for their hardware and software. After finding out that one of the software was loading too slowly from the data cassette, he motivated Wozniak to design the Disk II floppy disk drive system.

He retired from Apple following Jobs’ returned as CEO in 1996 and also supported his return in 1997 after NeXT.

The investor’s role that is not money

If you are thinking why did you read the brief history of Apple, It is to highlight the contributions of Markkula and even Terell as investors of something that was just an idea back then. Terell believed in the Steves and agreed on distributing their product. He further even got invested to suggest the cassette interface for loading and saving programs. Markkula started as an investor to switch to multiple executive roles in the company and finally retire- almost twenty years later.

After an investor comes on board, they are not just a capital source, but a part of the capitalization table. Deciding what’s important in an investor becomes essential. This will help you as a founder not only in filtering and screening but also help them make good decisions for your company.

Do not settle for money. Every investor can give you that. Look for what else will they contribute to the company.

You must find an investor that is right for the phase you are entering the market in. If you have started with a high amount of risk but you can do with seed funding, hold on to the investments provided by friends and family. Everyone wants that venture capital but proper risk calculation becomes necessary.

When an investor joins your team, their personal brand and portfolio will get associated with you. You do not want someone with any baggage of bad reputation that might affect your business to the slightest, especially when you are starting out.

Try that the same investor is a part of multiple funding rounds- they know your vision and this also prevents your ownership to be diluted further with only one investor who is constantly participating.

Their investment portfolio is the most important aspect of judgment. You need diversity, connections, you need a good success-failure ratio with an obvious weight in the success numbers, their experience, the number of investments, and most importantly, their influence in the market.

If the investor is known to have a portfolio full of startups that have started a business of something in trend, you must consider rejecting them. These are called lemming investors who believe in following a trend and jump to another as soon as there is one.

An investor suggesting that you won’t succeed without them is a big no. A right investor doesn’t think of themselves as bigger than the startup, they are there with you looking up at the goal you want to achieve- together.

Talk with the founders of other ventures the investor has invested in to get a better idea. You do not want an investor who is trying to amp up their funds while you are trying to change the world.

Do you watch telly?

Assuming you do, you must know of shows like Shark Tank and you must have thought of being there with four investors in front of you, fighting for investing in your idea where they see potential. That is not just great validation but also reflects the importance of the right investor. The game that you play in your mind where you do calculations as to what you would do if you were there is something that you need to do in real life while choosing the right investor. An investor does not and should not come in and take over your business. They lend you their money, expertise, and experience.

A good example could be another show, The Profit where the host Marcus Lemonis, as he claims, is trying to save the American dream one business at a time. Although the show is different where Marcus invests in businesses that he sees potential in but are almost on the verge of bankruptcy, the message remains the same. An investor who has what it takes for the company to survive.

Sometimes, all it takes is a few tweaks you hadn’t imagined would bring a substantial change.

The money IQ

Money does not have a GPS chip placed inside to track as your WhatsApp forwards suggest and it surely doesn’t have its brain to test its intelligence. But when it comes to investment, there comes a concept of Smart Money and Dumb Money.

It is not the money that is smart or dumb, it is the owner of that money we have to judge. Smart money is the money that comes from a smart investor, an investor with experience, an investor who was an entrepreneur once, with their own startup and knows the pain of starting something new and raising capital for it. This investor can help you in ways you yourself don’t know.

Dumb money comes from investors who won a lottery or got lucky in the share market or at Wall Street. They are investing the money because they have it, not because they want to, or believe in your idea. Ideally, you should stay away from dumb money, even in desperate times.

Then who is Mr./Ms. Right?

Someone who you don’t let into your bank, but your boardroom meetings where you ideate is the right investor.

A right investor has funded dumb ideas by taking risks, and not just blind risks but where they believe in the idea, the vision of your startup. They see the futuristic, rather, the timeless potential of your idea and can help you create something that will become a part of everyone’s life, or even better, a part of the culture and forever recorded in history.

Rejecting investors is not as easy as it might seem, you might not even be in a position to pick and choose. But remember, when you choose, it is a long term decision that will last as long as your venture will.

— by Manas, Content Strategist, Slangbusters Studio